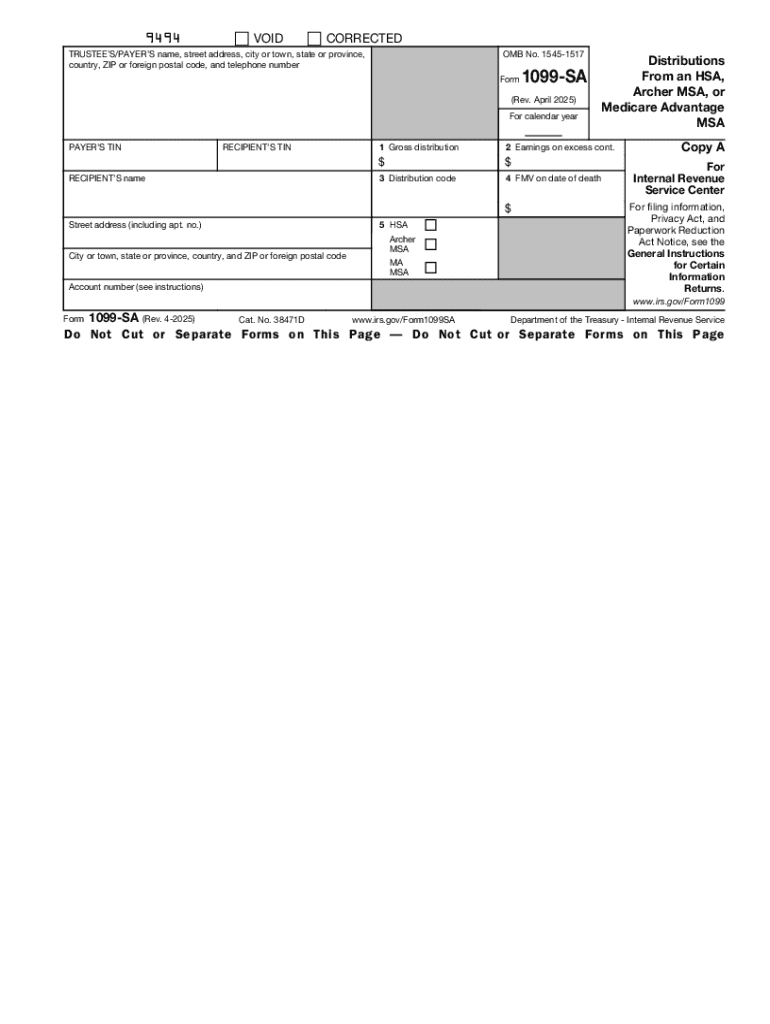

IRS 1099-SA 2025-2026 free printable template

Instructions and Help about IRS 1099-SA

How to edit IRS 1099-SA

How to fill out IRS 1099-SA

Latest updates to IRS 1099-SA

All You Need to Know About IRS 1099-SA

What is IRS 1099-SA?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1099-SA

What should I do if I realize I made a mistake on my IRS 1099-SA after submitting it?

If you discover an error on your IRS 1099-SA after submission, you should file a corrected form. This involves filling out a new 1099-SA, indicating it is a correction. Ensure you submit the corrected form to the IRS and send a copy to the recipient to rectify the original error.

How can I track the status of my submitted IRS 1099-SA?

To track the status of your IRS 1099-SA, you can use the IRS online tools for tracking filings or consult your e-filing software, which may provide status updates. Always confirm with the IRS timelines and common e-file rejection codes that might affect processing.

Are there any penalties for incorrect filings of IRS 1099-SA?

Yes, penalties may apply for incorrect filings of the IRS 1099-SA, such as ignoring deadlines or submitting inaccurate information. It's crucial to understand these penalties to ensure compliance and avoid unnecessary costs.

What are the privacy considerations when handling IRS 1099-SA data?

When managing IRS 1099-SA data, it's imperative to prioritize privacy and data security. Adhere to best practices in record retention and make sure sensitive information is protected, especially if shared digitally or with third parties.

See what our users say