Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

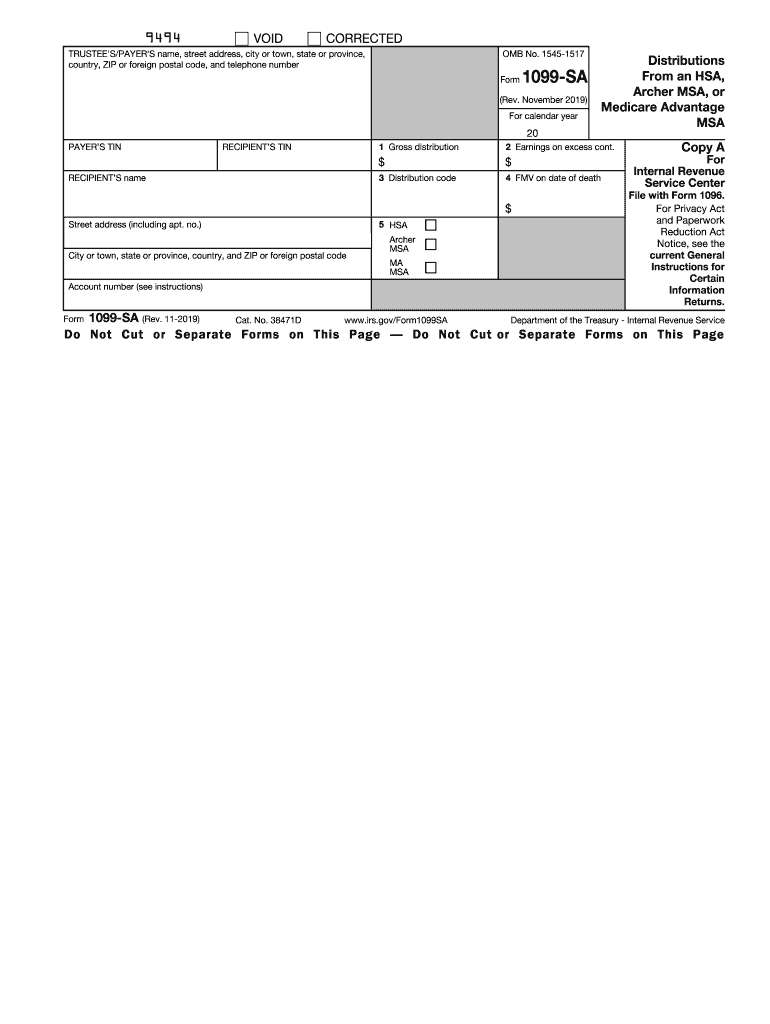

1099-SA is an IRS form used to report distributions from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. It lists the amount of the distributions and the amount of any taxes withheld. The form is used to report the information to the IRS.

1. Enter the recipient’s name, address, and taxpayer identification number (TIN) in the upper right corner.

2. Enter the payer’s name, address, and TIN in the upper left corner.

3. Enter the payer’s account number (optional).

4. Enter the total amount paid in box 1.

5. Enter any nonemployee compensation paid in box 7.

6. Enter any state income tax withheld in box 17.

7. Enter any federal income tax withheld in box 4.

8. Enter any other income in boxes 2, 3, 5, and 6.

9. Sign and date the form in the lower right corner.

10. Send copies of the 1099-SA to the payee and the IRS.

What is the penalty for the late filing of 1099 sa?

The penalty for late filing of 1099-SA is up to $50 per form. The maximum penalty is $536,000 per year for all intentional failures.

Who is required to file 1099 sa?

Individuals or businesses who make distributions from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA must file Form 1099-SA to report the distributions made during the tax year. This form is typically filed by the trustee or custodian of the HSA or MSA.

What is the purpose of 1099 sa?

The purpose of Form 1099-SA is to report distributions made from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), or Medicare Advantage Medical Savings Accounts (MA MSAs). These distributions generally include payments made to individuals for qualified medical expenses and are reported by the financial institution that administers the account. The form is used to report these distributions to the Internal Revenue Service (IRS) and to the recipient of the payment, so they can properly report it on their tax return.

What information must be reported on 1099 sa?

Form 1099-SA is used to report distributions you received from a Health Savings Account (HSA), Archer Medical Savings Account (Archer MSA), or Medicare Advantage Medical Savings Account (MA MSA). The information that must be reported on Form 1099-SA includes:

1. Payer's Information: This includes the name, address, and taxpayer identification number (TIN) of the HSA, Archer MSA, or MA MSA custodian or trustee who made the distributions.

2. Recipient's Information: This includes your name, address, and TIN as the person who received the distributions.

3. Distributions: The total amount of distributions you received from the account during the tax year.

4. Different Type of Distributions: The form may have separate boxes to report various types of distributions, such as qualified medical expenses, non-qualified distributions subject to additional taxes, excess contributions, or any other relevant category.

5. Contributions or Recontributions: Any contributions or recontributions made during the tax year should also be reported if applicable.

It is important to accurately report this information on Form 1099-SA as it is necessary for both the account holder and the Internal Revenue Service (IRS) to properly track distributions and ensure they are being used for qualified medical expenses.

When is the deadline to file 1099 sa in 2023?

The deadline to file Form 1099-SA for tax year 2023 would typically be January 31, 2024. However, it's essential to note that tax deadlines are subject to change, so it's always best to verify the exact due date with the Internal Revenue Service (IRS) or a tax professional closer to the time of filing.

How can I send 1099 sa for eSignature?

When you're ready to share your tax 1099 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an eSignature for the information 1099 in Gmail?

Create your eSignature using pdfFiller and then eSign your misc 1099 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete 1099 sa form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your form 1099 sa, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.